Just as Odysseus navigated the treacherous waters between Scylla and Charybdis, you too must find your way between the extremes of stringent budgeting and unrestrained spending. You’re faced with decisions that could either stretch your dollar or sink your financial ship. Consider how a well-planned budget could shield you from the lurking dangers of debt and financial uncertainty. Wouldn’t you like to know how a few simple adjustments to your spending habits might not only keep your bank account healthy but also enhance your academic success? Let’s explore which approach might actually work best for you.

Importance of Budgeting for Students

Understanding the fundamentals of budgeting is vital for students as it lays the groundwork for long-term financial stability. A recent survey by the National Endowment for Financial Education found that only 24% of students feel confident in their budgeting skills. This lack of confidence can lead to serious financial pitfalls.

By learning to budget early, you not only prepare for your immediate expenses but also equip yourself to dodge the common debt traps linked to student loans and impulsive credit spending. An analysis from the Consumer Financial Protection Bureau revealed that students who engage in budgeting are 30% more likely to graduate without debt compared to those who don’t.

Mastering budgeting now will streamline your financial management and ensure a more secure future. Consider the story of Sarah, a junior at State University, who transformed her financial situation by adopting a strict budgeting plan. After tracking her expenses for a month, she realized she was spending $200 monthly on dining out. By switching to meal prepping, she saved $150 each month, which she redirected towards her savings and student loan payments.

the Basics of Budgeting

Understanding the essentials of budgeting is crucial for students aiming to maintain financial stability and achieve their personal and academic goals. A solid budget not only helps you allocate funds wisely but also provides a clearer picture of your financial landscape.

Creating a Student Budget Plan

Developing a practical student budget plan is essential for managing your finances effectively and avoiding unnecessary debt. Start by tracking your income, which may come from part-time jobs, internships, or family contributions. Prioritize your expenses by categorizing them into needs (like rent, tuition, and groceries) and wants (such as entertainment and dining out).

- Essentials: Rent, food, utilities, transportation

- Non-essentials: Eating out, subscriptions, shopping

Establish a budget that sets aside funds for essential expenses first, and practice discipline by limiting spending on non-essential items. This approach not only maximizes your resources but also minimizes financial stress.

Benefits of Budgeting Early in Life

Embracing budgeting early in life fosters a sense of financial independence and encourages responsible spending habits. By learning to prioritize needs over wants, you ensure that your essential expenses are covered first, paving the way for a more secure financial future.

This proactive strategy not only helps you avoid debt but also empowers you to make informed financial decisions. A case study from the University of Florida showed that students who created budgets reported higher satisfaction and less anxiety related to their finances.

Financial Independence and Responsibility

Mastering budgeting skills early establishes a strong foundation for financial independence and responsibility. According to a report from the National Student Financial Wellness Study, students who regularly budget are more likely to save for future goals and manage unexpected expenses effectively.

It’s crucial to adopt these habits now, as they will significantly influence your long-term financial health. Begin by diligently tracking your expenses and setting realistic budgets that reflect your income and expenditure patterns.

Avoiding Student Debt Traps

Understanding how to budget effectively can shield you from the pitfalls of crippling student debt. As a student, you’re often overwhelmed with financial choices—from textbooks to social outings—and tracking your money is essential.

By establishing a clear budget, you can avoid overspending and accumulating unnecessary debt. Start by tracking your income from various sources, whether it’s from a part-time job, parental support, or student loans. Next, list your monthly expenses, categorizing them into needs (like rent and groceries) and wants (such as eating out and entertainment). This visibility allows you to make informed decisions, prioritizing essentials and cutting down on less critical expenditures.

Allocate a portion of your income to savings—even a small amount each month can accumulate over time, creating a buffer for unexpected expenses or emergencies. Additionally, be strategic with your student loans. Understand the terms, compare interest rates, and consider the long-term impact on your finances. Opting for federal loans over private ones can often provide more favorable terms and repayment options.

In summary, budgeting is not just about managing money; it’s about building a secure financial future. By implementing effective budgeting strategies now, you can avoid debt traps and set yourself up for long-term success.

Practical Budgeting Tips for Students

As you navigate your college years, it’s essential to keep a detailed track of both your expenses and income sources to maintain financial stability. Setting realistic financial goals will help you prioritize your spending and save for future needs.

Don’t forget to take advantage of student discounts and deals, which can stretch your budget further while managing any student loans and scholarships efficiently.

Tracking Expenses and Income Sources

To effectively manage your finances as a student, it’s crucial to start by tracking all your income sources and expenses. This methodical approach not only illuminates where your money comes from and where it goes, but also reveals spending patterns and potential savings opportunities.

You’ll first want to list all your income sources, which may include part-time jobs, scholarships, stipends, and parental support. Next, categorize your expenses. Common categories include rent, groceries, transportation, textbooks, and entertainment.

Use tools like apps, spreadsheets, or good old-fashioned pen and paper to record every transaction, no matter how small. Consistency is key; update your records regularly to maintain a clear picture of your financial health.

Analyzing this data helps you understand your financial behavior. You might discover that you’re spending excessively on things like eating out or online subscriptions. With this insight, you can identify areas for adjustment.

For instance, preparing meals at home or opting for less expensive entertainment options can considerably reduce your expenses.

Setting Realistic Financial Goals

As you navigate through your academic journey, it’s vital to prioritize the establishment of an emergency fund. This proactive financial strategy guarantees you’re prepared for unforeseen expenses, which can alleviate potential stress and maintain your focus on studies.

Start by setting aside a small, manageable sum each month, gradually building a buffer that can safeguard your financial well-being.

Building an Emergency Fund

You’ll need to set aside a portion of your income each month to build an emergency fund that can cover unexpected expenses. Start small, even if it’s just a few dollars, and gradually increase the amount.

This proactive approach guarantees you’re prepared for financial surprises without derailing your budget. It’s not just about saving; it’s about securing your financial independence as a student.

Utilizing Student Discounts and Deals

Maximize your savings by exploring student discounts and deals offered by numerous businesses. Retailers, restaurants, technology providers, and even travel services recognize the financial constraints many students face and offer reduced prices upon presentation of a valid student ID or a university email address. This isn’t just about saving a few pennies; it’s about significantly lowering your monthly expenses.

First, identify the types of purchases you make regularly. Do you buy books, technology, or clothes? Do you eat out often or travel on weekends? Once you know where your money goes, look for businesses in those sectors that offer student discounts. Many major software companies provide significant discounts on applications essential for your studies, which can save you hundreds of dollars.

Additionally, don’t overlook smaller local businesses or online startups. They often provide competitive discounts to attract students and might offer unique products or services that better meet your needs. Signing up for student discount websites can also alert you to deals you might otherwise miss.

Managing Student Loans and Scholarships

Managing your student loans and scholarships effectively is essential for maintaining financial stability throughout your college years. It’s not just about covering your tuition; it’s about strategically leveraging these funds to guarantee you’re not overwhelmed by debt post-graduation.

Here are practical steps to take:

- Understand Your Loan Terms: Know your interest rates, repayment terms, and any potential benefits that come with your student loans. Don’t wait until graduation to figure these out.

- Apply for Scholarships Regularly: Even if you’re already receiving financial aid, continuously seek out scholarships. There are countless opportunities that can help reduce how much you need to borrow.

- Set a Budget: Use your loan and scholarship money wisely by creating a budget that includes your essential expenses and stick to it. This will help you avoid unnecessary borrowing.

- Prioritize High-Interest Loans: If you have multiple loans, focus on paying off the ones with the highest interest rates first to reduce the total amount of interest you’ll pay over time.

- Keep Records: Maintain detailed records of your borrowings, scholarship awards, and expenditures. This won’t only help you stay organized but also prepare you for financial responsibilities after college.

Challenges Faced by Students in Budgeting

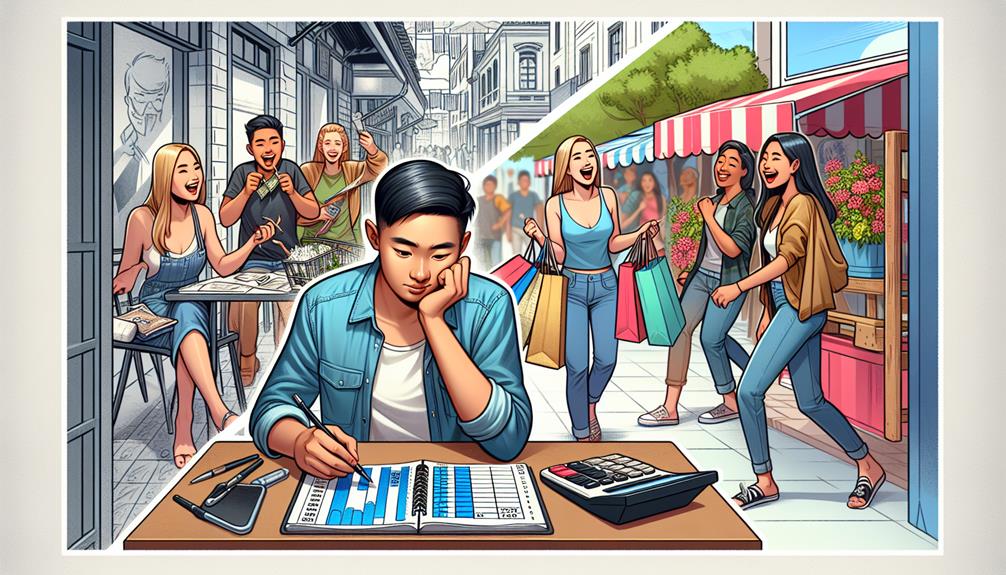

As you navigate budgeting, you’ll find that peer pressure can often lead to unplanned social spending, which disrupts your financial goals.

You must also balance your educational expenses with personal spending, ensuring neither is neglected.

Lastly, it’s important to curb impulse purchases and resist lifestyle inflation that can quietly deplete your funds.

Peer Pressure and Social Spending

Under the influence of peer pressure, students often struggle to adhere to their budgeting plans due to social spending. This challenge is particularly acute in college environments where social interactions frequently involve spending money. Whether it’s eating out, attending concerts, or weekend trips, the pressure to join in can make it tough for you to stick to your financial goals.

To combat this, consider the following strategies:

- Set clear priorities: Decide what matters most to you and allocate your funds accordingly. Is attending every social event more important than your financial health?

- Communicate openly: Don’t be afraid to share your budget constraints with friends. Chances are, they might also be looking for ways to cut back.

- Suggest cost-effective alternatives: Propose activities that are less expensive but equally fun, like potluck dinners or free community events.

- Learn to say no: It’s okay to decline invitations when attending would strain your budget. True friends will understand.

- Track your spending: Regularly review where your money goes. This visibility can deter you from overspending and help you stay on course.

Balancing Education Costs and Personal Expenses

As you navigate the tightrope between education costs and personal expenses, considering a part-time job might seem like a viable solution. However, you’ll need to manage your time effectively to make sure it doesn’t interfere with your studies.

Strategically balancing work hours with academic responsibilities is essential to maintaining both your financial and educational goals.

Dealing with Part-Time Jobs and Time Management

Balancing part-time work with academic responsibilities can greatly challenge your ability to manage time effectively, impacting both your budgeting efforts and academic performance.

Here are some practical tips:

- Prioritize tasks by urgency and importance.

- Use a digital calendar for scheduling shifts and study time.

- Set clear financial goals each semester.

- Learn to say no to extra shifts during exam periods.

- Allocate specific times for rest and rejuvenation.

Overcoming Impulse Buying and Lifestyle Inflation

Many students struggle to resist impulse buying and manage lifestyle inflation, essential skills for effective budgeting. As you progress through your academic and professional life, the temptation to spend more as you earn more can strain your finances. It’s crucial to recognize the triggers that lead to unnecessary spending. Often, emotional spending or the desire to keep up with peers can push you into making impulsive purchases.

To combat this, start by setting clear, realistic financial goals. Ask yourself what you’re saving for – is it education, travel, or perhaps starting a business? Keeping these goals in mind can help you think twice before splurging. Additionally, create a detailed budget that accounts for your essential needs first – rent, food, utilities, and savings. Stick to this budget rigidly.

Whenever you’re tempted to buy something on a whim, give yourself a waiting period. If you still think it’s necessary after a week, then reassess its value and your budget. Utilize apps that track spending habits and alert you when you’re veering off course.

Long-Term Financial Planning for Students

As you navigate your academic journey, it’s important to start investing early to secure your financial future.

Understanding and managing your credit score is vital, as it affects your ability to borrow money and secure housing.

Investing for the Future

As a student, you may think it’s too early to start thinking about retirement planning and wealth building, but beginning now can set you up for a secure future.

By allocating even small amounts of your budget to investments, you’re taking advantage of compound interest, which grows your money exponentially over time.

It’s essential to educate yourself on different investment options and consider speaking with a financial advisor to tailor a plan that fits your long-term financial goals.

Retirement Planning and Wealth Building

You should start investing early to build wealth and secure your retirement, even while you’re still a student.

- Start Small: Even modest savings can grow over time.

- Use Compound Interest: Reinvest earnings to increase your returns.

- Diversify Investments: Spread out risk to optimize returns.

- Plan for Long Term: Focus on growth over immediate gains.

- Seek Advice: Consult financial advisors to refine your strategy.

Credit Scores and Building Credit History

Understanding how to build a strong credit score is essential for long-term financial stability as a student. A good credit score can open doors to better loan rates, rental approvals, and even some job opportunities. To start, you’ll need to establish credit. One manageable way is by obtaining a student credit card. Use this card wisely; charge small amounts and pay your balance in full each month. This shows lenders you’re responsible and can manage debt effectively.

Additionally, consider becoming an authorized user on a parent’s credit card. This can give your credit score a boost, provided the primary user maintains a good payment history.

Always monitor your credit score and report through free services offered by many financial institutions. This vigilance helps you spot errors or fraudulent activities early on.